Inflation and Family Finances in 2023

We surveyed nearly 2,400 parents to determine how rising prices affect their everyday lives.

According to the U.S. Bureau of Labor Statistics, in October 2019, a gallon of milk cost $3.12, a pound of chicken cost $1.54, and a dozen eggs cost $1.28. Today, a gallon of milk costs $3.97, a pound of chicken is $1.96, and a dozen eggs will run you around $2.07. Now, an extra 85 cents for milk, 42 cents per pound of chicken, and 79 cents for a dozen eggs may not seem that extreme, but when you add those little increases up with the rise in prices of every other product in a typical grocery store run for a family, the bill grows significantly.

And it’s not just prices at the grocery store that have risen over the last few years—it’s everywhere. Between 2021 and 2022, the cost of a pack of diapers went up by 20%, baby food rose 11.8%, and car seats increased 41%. Between October 2019 and September 2023, the price of a gallon of gas has risen by $1.32, and natural gas (for the home) increased by 34 cents per therm. The childcare crisis has only worsened, with a 6% price increase between July 2022 and July 2023. Finally, in 2023, health insurance premiums grew 7% from 2022, and they’re expected to increase again in 2024. The rising costs feel impossible to keep up with, and millions of families across income brackets have had no choice but to scale back on things they enjoy over the last few years in order to keep their children warm, fed, and clothed.

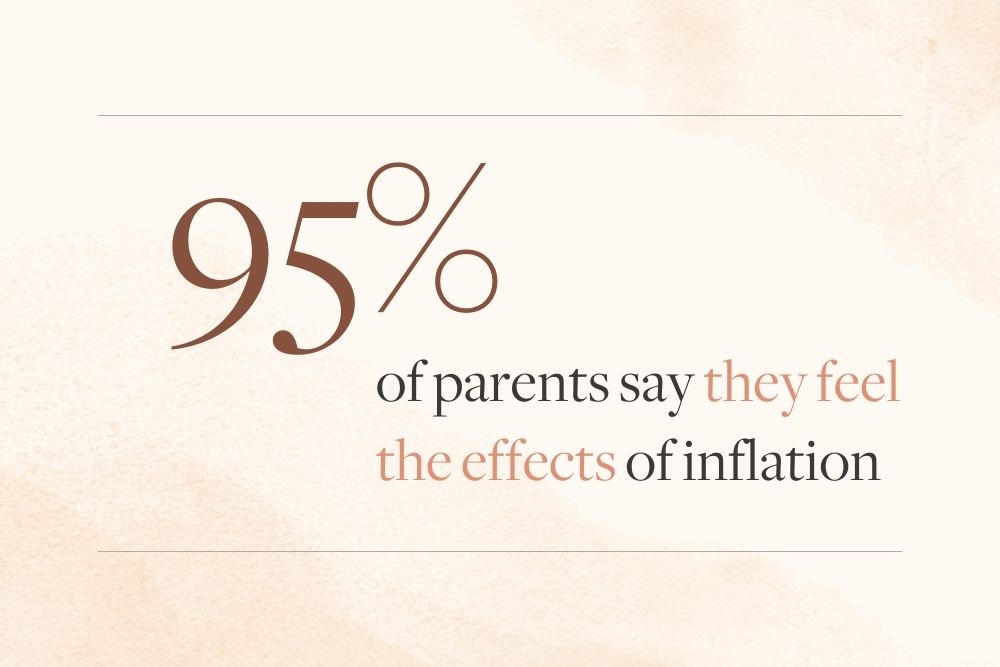

Still, even though most of us have felt the effects of rising costs, it doesn’t always appear that way. One quick scroll through Instagram will lead you to believe that everyone is going on lavish vacations, that you simply must stow away your skinny jeans and invest in wide-leg styles if you want to avoid looking like “a boring mom,” and that expensive meal delivery kits that save you 30 minutes at dinner time are worth the upcharge (on the already overpriced food). Feeling like you’re the only one having to cut back on expenses can bring a whole flood of emotions. But we’re here to tell you that you are not alone, despite what it seems. The Pregnancy & Newborn editorial team surveyed nearly 2,400 parents to find out how inflation has affected them over the last few years, and the results clearly indicate that more families are struggling with rising prices than many of us realize—in fact, 95% of survey respondents say they are feeling the effects of inflation.

How We Got Here

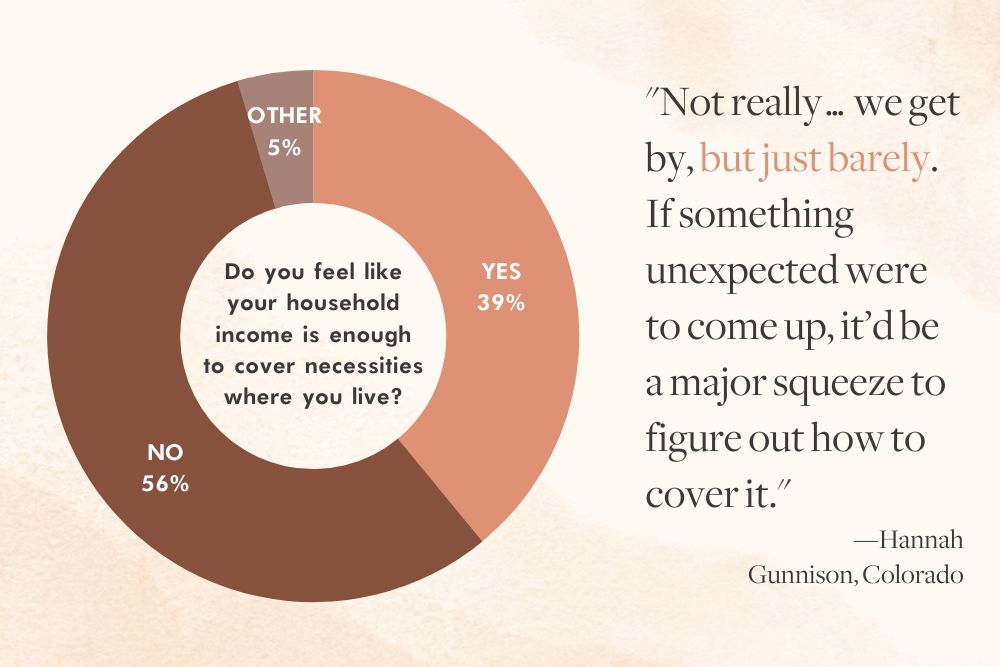

Inflation is nothing new; in fact, it’s to be expected. The Federal Reserve aims for an annual inflation rate of about 2%. Of course, in some years, inflation may be a little lower or a little higher than 2%, but overall, the Federal Reserve raises and lowers interest rates to help control inflation and keep our economy as steady as possible. Unfortunately, things haven’t happened this way in the last few years, and more than half of our survey respondents say their current household income isn’t enough to cover the products and services required to meet their basic needs.

With any product, pricing is based on how much it costs to manufacture the item (including parts and labor) and supply and demand. When there is a surplus of supply and low demand, prices are low; when there isn’t enough supply to meet demand, prices go up. In early 2020, the start of the COVID-19 pandemic, much of the world came to a stop. For months, all across the globe, workers were sent home, factories shut down, and only essential employees were expected to show up for in-person jobs. This meant production in a lot of industries came to a halt, so supply decreased.

During this time, in the U.S., the federal government was doing everything it could to avoid a rapid recession, including supplementing state unemployment programs, sending stimulus checks to millions of families, distributing paycheck protection program (PPP) loans with little oversight, significantly cutting interest rates (particularly affecting mortgages), and offering steep tax cuts to individuals and businesses. This kept the economy going, but with so many people stuck at home with nowhere to go and a little extra money in their bank accounts, they shopped. Soon enough, demand was much higher than supply on pretty much everything, so prices increased dramatically.

By the second quarter of 2021, most industries were close to or back to their pre-pandemic output. Still, between December 2020 and December 2021, consumer prices (used to measure inflation) rose by 7%, the most significant jump our country had seen since 1981. Then, between December 2021 and December 2022, consumer prices increased again, this time by 6.5%. Why were prices still climbing long after supply had stabilized? This time, experts say, it was because the number of vacant jobs was much higher than the number of unemployed people, making it a job seeker’s market. This period was labeled “The Great Resignation,” as millions left their jobs for better pay, better benefits, and more growth opportunities. In order to compete in recruiting top talent, companies had to increase starting wages, leaving consumers to foot the bill with higher-priced products.

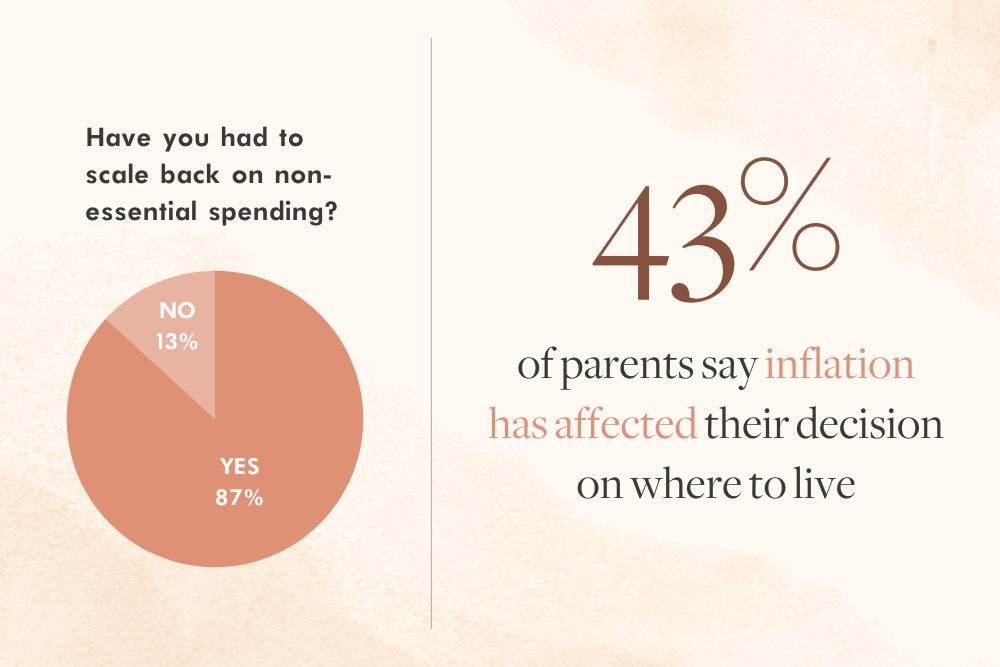

At this time, the Federal Reserve was also in the process of increasing interest rates. While this move was meant to help cool inflation, it negatively impacted mortgages; combined with years of dramatically rising home prices, it has made it increasingly more difficult for a family to afford a home in the U.S. As a result, 43% of our survey respondents said the rising costs associated with inflation have impacted their decision on where to live.

Finally, many of the special tax breaks that helped families during the pandemic ended in 2022, which cut off spending money many had come to rely on to help cover rising living costs. In our survey, 87% of parents reported having had to scale back on non-essential spending. We also asked parents how inflation has affected their kids’ lives. A number of parents said they’re unable to afford childcare, and many expressed disappointment that they can no longer afford to buy things their kids enjoy. Laken, from Thomasville, North Carolina, said, “Since [our daughter is] so young, it’s easier to hide, but we can’t afford new toys, clothes, or take her anywhere fun.”

Inflation vs. Corporate Greed

Between COVID-19, supply and demand struggles, worker demands, and the war in Ukraine, there’s no doubt that there were a lot of contributing factors to the rapid rise in prices between 2020 and today. But between production output going back to normal, budgets being adjusted for higher worker salaries, and The Federal Reserve’s rising interest rates, shouldn’t we be seeing a steady decrease, or at the very least stabilization, in prices? Well, that’s the idea—except these tactics used to stabilize an economy don’t seem to consider corporate greed.

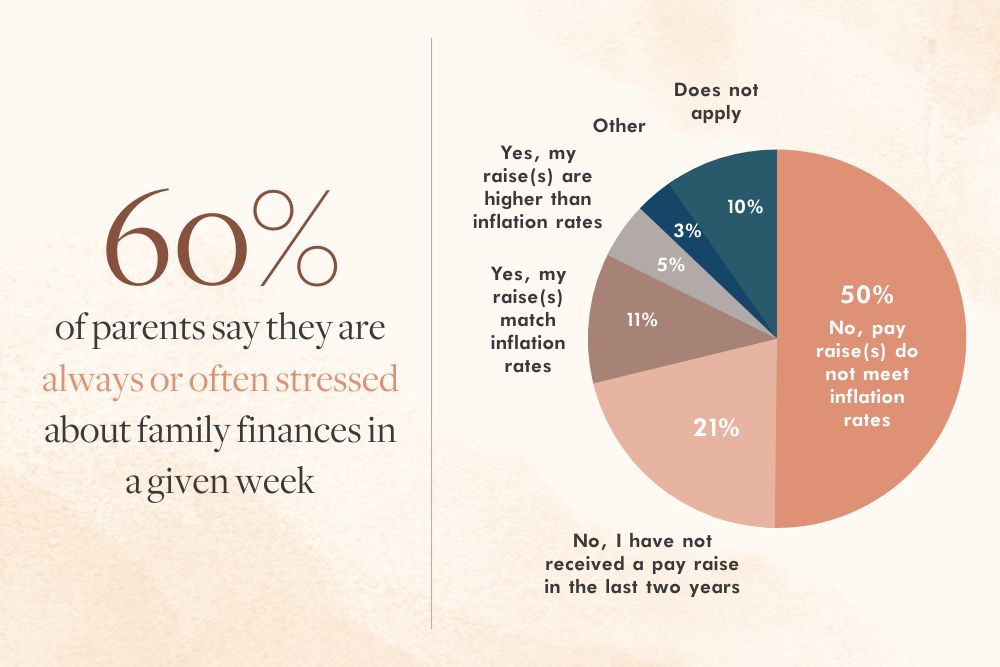

Despite corporations’ narrative that they had to increase product prices in order to increase worker salaries, between April 2021 and January 2023, wage growth did not keep up with inflation. As a result, for many of the Americans who were lucky enough to get a raise during this time, it wasn’t nearly enough to keep up with the rising costs. Over 71% of our survey respondents said they had not received a cost of living pay increase over the past two years, or if they did receive one, it did not match the rate of inflation. Today, wage growth is slightly higher than inflation, but too many families are still trying to play catch up from the last few years to feel any financial relief. In fact, most of the parents we polled admitted to often or always feeling stressed over family finances.

Further, in May 2023, the New York Times reported, “Some of the world’s biggest companies have said they do not plan to change course [in raising prices of goods and services] and will continue increasing prices or keep them at elevated levels for the foreseeable future,” despite reporting record profits. At the end of 2022, General Mills reported a 16.5% net income increase (bringing the total to $2.7 billion), and the company’s profits continue to grow in 2023.

Similarly, Tyson increased its net income from $3 billion in 2021 to $3.2 billion in 2022—and shareholders are being rewarded generously as a result. PepsiCo saw similar results, with a 16.9% net income increase in 2022 and continued increases in 2023.

Looking Forward

The thing is, companies will continue raising prices until consumers stop purchasing them, forcing a decrease in cost. But not buying a good is easy when the product is non-essential, and your family will quickly adapt to not having it; it’s not so easy when that product is milk, heat, or clothing for little kids who grow like weeds.

So, what are we supposed to do? Because, as our survey results show, going on with business as usual isn’t sustainable for us financially or mentally. Most families are working harder just to stay afloat right now, and many can’t even begin to think about financial planning for the future. Almost half of the parents who participated in our survey reported that they’re unable to make monetary contributions to their retirement savings at this time. If this trend continues, millions of parents may not be able to afford retirement and potentially face becoming financially incapacitated by surmounting debt.

The good news is, while it may not seem like it, prices of some goods and services have steadily decreased over the last year. As much as we’d all like a little breathing room, a slow reduction is ultimately better for the economy because a fast “deflation” is typically the result of a “very severe recession,” according to an NBC interview with economist Michael Pugliese. As of July, The Federal Reserve projects inflation to remain above 3.5% through 2024. This may sound grim, but keep in mind that inflation in 2023 is currently at 3.7% (significantly better than 7% in 2021 and 6.5% in 2022), so the 2024 projection is still a reduction. The process is slow, but it is working.

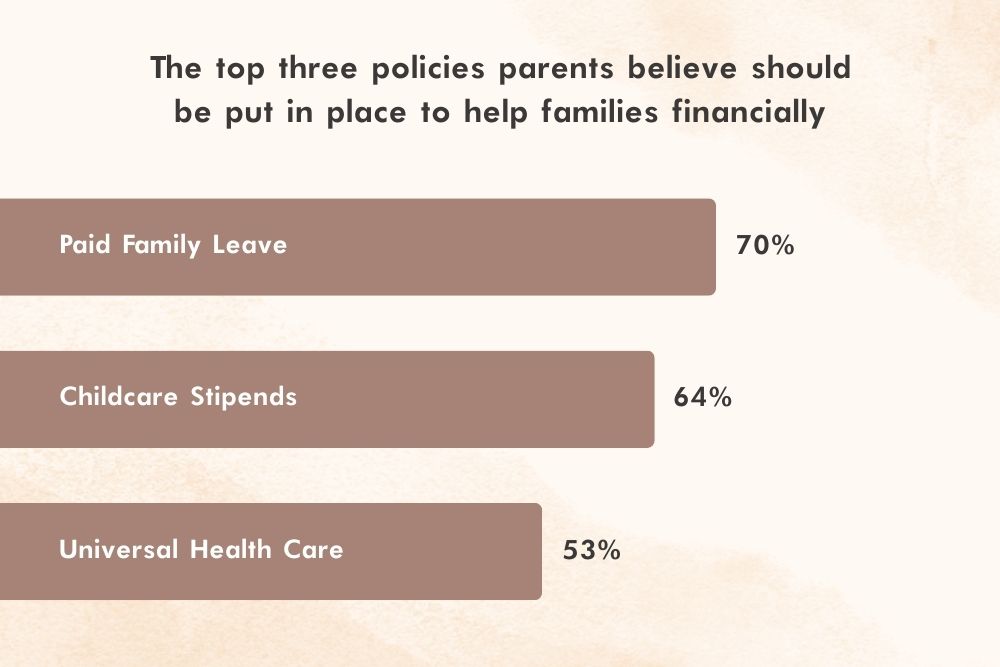

The effects of inflation are being felt nationwide, and we will likely continue to see them unfold for years to come. With this significant decrease in spending power (which particularly hurts lower-income households), there’s no better time than now to reassess how we do things in this country and what safety nets we have in place for our citizens. Instead of offering tax cuts to the rich to stimulate “trickle-down economics,” the parents we surveyed have other ideas—like paid family leave, universal healthcare, and childcare stipends, to name a few. As it stands, too many of today’s parents are unable to save money for an emergency or retirement, can’t pay off student loans, aren’t able to set aside money for their kids to go to college someday, can’t purchase a home, or possibly even grow their families despite wanting to. We may not be able to do anything about the inevitability of inflation, but we can vote for politicians who will advocate for us and put policies in place to ensure families are able to survive economic changes.

We’d like to thank the 2,394 parents who participated in our survey. Your input is valued, and we appreciate your willingness to share your stories with us. If you’d like to participate in future editorial projects for Pregnancy & Newborn, subscribe to our newsletter for regular updates and opportunities.